Sales Tax

Configuration > Point of Service > Sales Tax

Sales Tax can be recorded at the Point of Service based on item and building configuration.

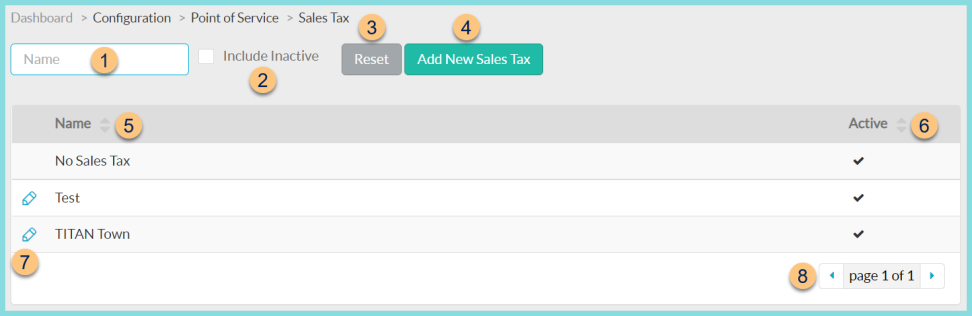

Sales Tax Screen

-

Name - search by name

-

Include Inactive - check to include inactivated items in results

-

Reset - click to reset search parameters

-

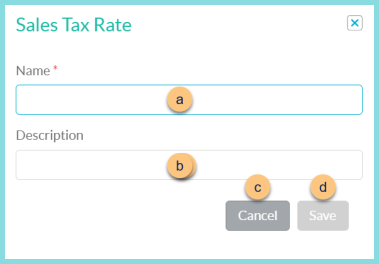

Add New Sales Tax - click to add a new tax structure

-

Name - enter a name

-

Description - enter a description

-

Cancel - click to return to create new structure and be redirected to the individual sales tax screen (details below)

-

Save - click to save changes

-

Name - click to sort by name

-

Active - click to sort by active status

-

Pencil - click to be redirected to the individual sales tax screen

-

< > - click to scroll through pages

The following structure exists by default:

-

No Sales Tax (protected)

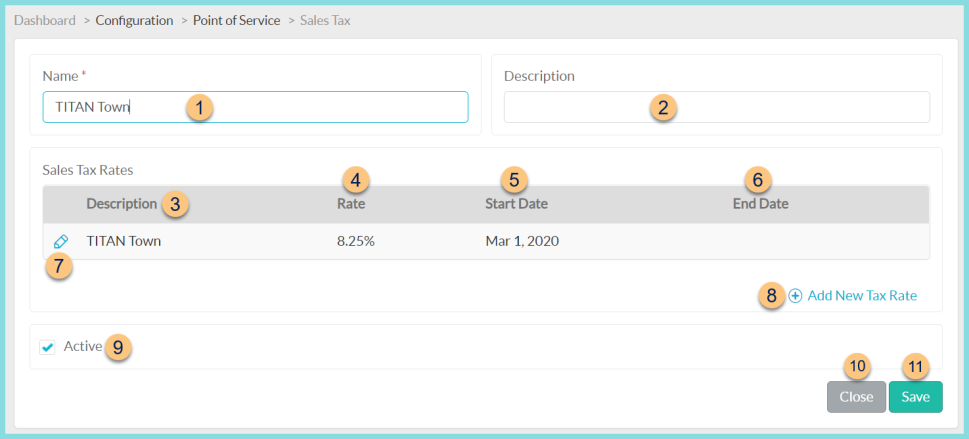

Individual Sales Tax Screen

-

Name - change name if needed

-

Description - change Sales Tax Description if needed

-

Description - notice Sales Tax Rate Description

-

Rate - notice tax rate

-

Start Date - notice the tax rate start date

-

End Date - notice the tax rate end date

-

Pencil - click to edit existing tax rate

-

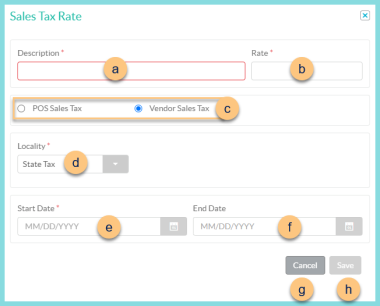

Description - enter Sales Tax Rate Description

-

Rate - enter rate as a percentage (Ex: 8.25 NOT .0825)

-

POS Sales Tax, Vendor Sales Tax - select whether this rate applies to POS sales or Vendor receipts

-

Locality (Vendor Sales Tax only) - select whether this is the State Tax, County Tax, or Local Tax. Note: If POS Sales Tax is selected, State is the only available locality. Enter the entire sales tax rate as needed for POS Sales Tax.

-

Start Date - select the tax rate start date

-

End Date - select the tax rate end date or leave blank if the end date is unknown

-

Cancel - click to return to the previous screen without saving changes

-

Save - click to save changes

-

(+) Add New Tax Rate - click to add a new tax rate. See Step 7 for details.

-

Active - toggle active status

-

Close - click to return to the previous screen without saving changes

-

Save - click to save changes